Foreign investment/ownership of Canadian real estate has long been a contentious issue for both industry players and foreigners. The Canada Mortgage and Housing Corporation has come out with statements regarding this over the past couple of months; saying that overseas capital is responsible for the recently observed price spikes in luxury housing.

In Vancouver & Toronto, it is very possible that foreign buyers account for a substantial portion of the demand for pricier, luxury single-family homes, although hard numbers on the phenomenon have yet to come in.

CBC News on Monday March 7th, 2016 asked Canadians during a live forum to discuss the matter. The conference concluded that most Canadian consumers want to see tighter regulations of foreign capital moving its way through Canada’s markets. Forum attendees mentioned increased evidence of vacant-but-owned homes as emblematic of the problem of greater foreign prominence.

The group felt there should be a levy or tax on ‘under-occupied’ residences; this can be verified by collecting data from utilities providers which could strongly indicate whether a property or unit is actually occupied. Had a resident acquired the property as a residence, they would have an income, payroll, and be a sales tax-paying member of the community. Yet as a non-resident, the foreign investor sitting on a vacant property gives nothing back to Canada. Adding a regulation or possible retroactive regulation would greatly help with improving affordability.

There was a general consensus that for housing prices to be corrected, 3 needs would need to happen:

- A raise in interest rates

- Outlaw shadow flipping and ensure hefty taxesare paid each time there is a change to property ownership

- Tax foreign owners at least 50%of the assessed value unless they can prove occupancy at least six months a year.

Others argued that regulation would not be a good move; especially in an economy hurting from the continuing state of low global oil price They say things like, “Why should Canadians deter investment in this country? The housing market employs and creates tens of thousands of jobs in the construction industry.” “We don’t need a political agenda messing up free enterprise based on folklore surrounding foreign ownership.”

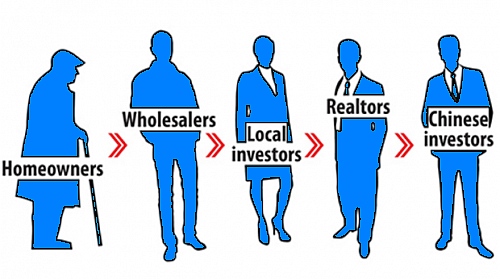

Others argued that Chinese investors smuggle out millions in embezzled cash, hot money or perfectly legal funds, bypassing the $50,000/year limit in legal capital outflows. They make “all cash” purchases, usually sight unseen, using third parties intermediaries to preserve their anonymity, or directly in person, in cities like Vancouver, New York, London or San Francisco. The house becomes a new “Swiss bank account”, providing the promise of an anonymous store of value and retaining the cash equivalent value of the original capital outflow.

Some speculate that hundreds, if not thousands, of Vancouver houses, have become a part of the new normal Swiss bank account: “a store of wealth to Chinese investors eager to park “hot money” outside of their native country, and bidding up any Canadian real estate they could get their hands on.”

~

Would you like to super-charge your career with 40+ fresh & real leads per month? Just contact us for for information on our Canadian Real Estate Lead marketing system.